Synchronisation with banks and bank reconciliation

Azopio enables these users to reconcile their accounting documents with their bank transactions, so as to simplify invoice tracking, quickly identify missing supporting documents and gain precise visibility of debts and receivables due. Here’s how to get started with your bank reconciliations.

Connect your bank(s)

Azopio, via its partner Powens by Budget Insight, can connect your bank account(s) directly to your space. Select your bank from over 2000 financial institutions in France and Europe. And whether your bank is traditional (Crédit Agricole, BNP Paribas, Crédit Mutuelle, etc.) or a neo-bank (Qonto, Revolut’, N26, etc.), it can be connected to our solution.

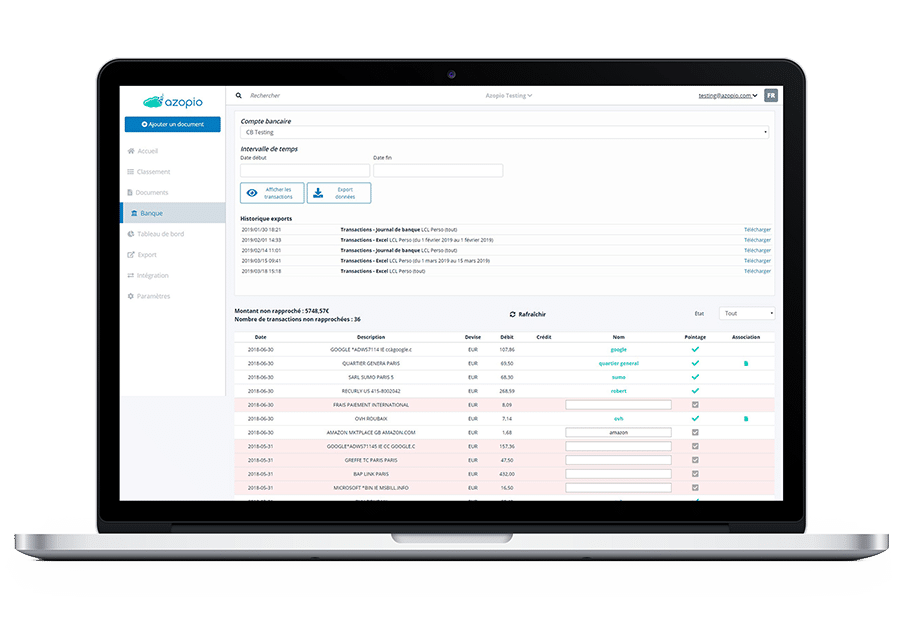

Select the bank account(s) to be synchronised for automated downloading of bank flows

Then choose the accounts you want to synchronise, and your banking data will be automatically uploaded to your account. No need to connect to your bank and download your monthly bank statements, save time by receiving your transactions, in your space, in real time !

Confirm automated bank reconciliations

Azopio then associates the voucher previously collected by Azopio with the transaction. All you have to do is validate the association to find your voucher automatically placed opposite the corresponding transaction.

Keep track of your debts, receivables and VAT using our dashboards

With Azopio, you can use dashboards and Excel exports to provide a real-time overview of your finances (cash flow, debts/receivables by supplier, etc.). Thanks to Azopio, this previously tedious and time-consuming operation becomes simple and easy.